The bankruptcy of the energy company Enron remains the biggest financial gamble in American history. The consequences of this fraud were enormous. Together with Enron, dozens of other related companies sank into oblivion, hundreds of employees lost their jobs and thousands of investors lost their deposits. Read more about the scam of the century on houstonski.

The founding and rise of Enron

Everything started out quite promising. In 1985, the merger of two companies, Houston Natural Gas Corporation and InterNorth Inc. formed one large energy corporation called HNG InterNorth. The following year, the complicated and incomprehensible name was changed to the more ostentatious and simple Enron. Everything pointed to the company’s future success. It was an energy-related company, which already made its collapse unlikely.

Gradually, the corporation increased its assets and expanded its sphere of influence. These factors caused a great deal of excitement among ordinary people to buy shares in the company. Everyone saw such investments as the key to success and a win-win option for a peaceful retirement. People started buying shares in large volumes, which increased the company’s capital and the value of the shares themselves.

In the early 1990s, the US Congress passed a series of laws to deregulate the sale of natural gas. After that, Enron lost its exclusive right to operate its own pipelines. This was the beginning of the corporation’s fraud. With the help of Jeffrey Skilling, who was initially a consultant and later became the company’s chief operating officer, Enron turned into a trader of energy derivatives contracts.

In simple terms, the company retrained as an intermediary between giant energy companies and customers who bought energy resources. Having become virtually a monopoly in this area, Enron began to make extremely large profits from these transactions without actually producing anything. This success and the economic situation in the world in the 1990s allowed the company to further develop its ambitions.

Deals were made everywhere. Enron was willing to create a market for almost anything, for anyone and trade whatever there was a bid for. The firm traded derivative contracts on a wide range of commodities, including electricity, coal, paper and steel and even the weather. They were among the first in the US to start online trading. The daily trading turnover was approx. $2.5 billion.

Decline and bankruptcy

For several years, the company was doing just fine. But as competition intensified and the company became overconfident in its ambitions, its profits began to decline significantly. Fearful of negative pressure from shareholders, Enron’s top management began to look for a way out. Since it was not possible to really change the current situation, it was decided to hide the real income by falsifying accounting reports. The main method of such fraud was to record unrealized profits from future transactions in current reports as if they had already taken place. To hide the real state of affairs from the audit companies, they made Arthur Andersen, an independent auditor and accountant, a consultant to the company.

Such fraud masked the real situation, but did not solve the problem. The situation escalated in mid-2001, when financial analysts began to scrutinize Enron’s reports in more detail. A national economic scandal was brewing. The company decided to gradually reveal the truth about its financial condition. In October of the same year, Enron informed investors of a $638 million loss and a $1.2 billion reduction in share capital.

Following this announcement, the U.S. Securities and Exchange Commission launched an investigation. As a result of the review of documents, although a significant number of them were destroyed by Enron employees, details of the grandiose fraud began to emerge. The search for the perpetrators began, and the company began a rapid decline. Shares plummeted from $90 to $12. However, the largest shareholders managed to get rid of their assets before the case was made public. Enron’s management still had hope of saving the situation, so they announced the sale of the company.

However, none of the competitors wanted to take on the responsibility of a company that had been discredited in the eyes of the public. This led to an even greater depreciation of Enron shares. The price fell below $1. This was the final nail in the company’s coffin. On December 2, 2001, Enron filed for bankruptcy.

The butterfly effect

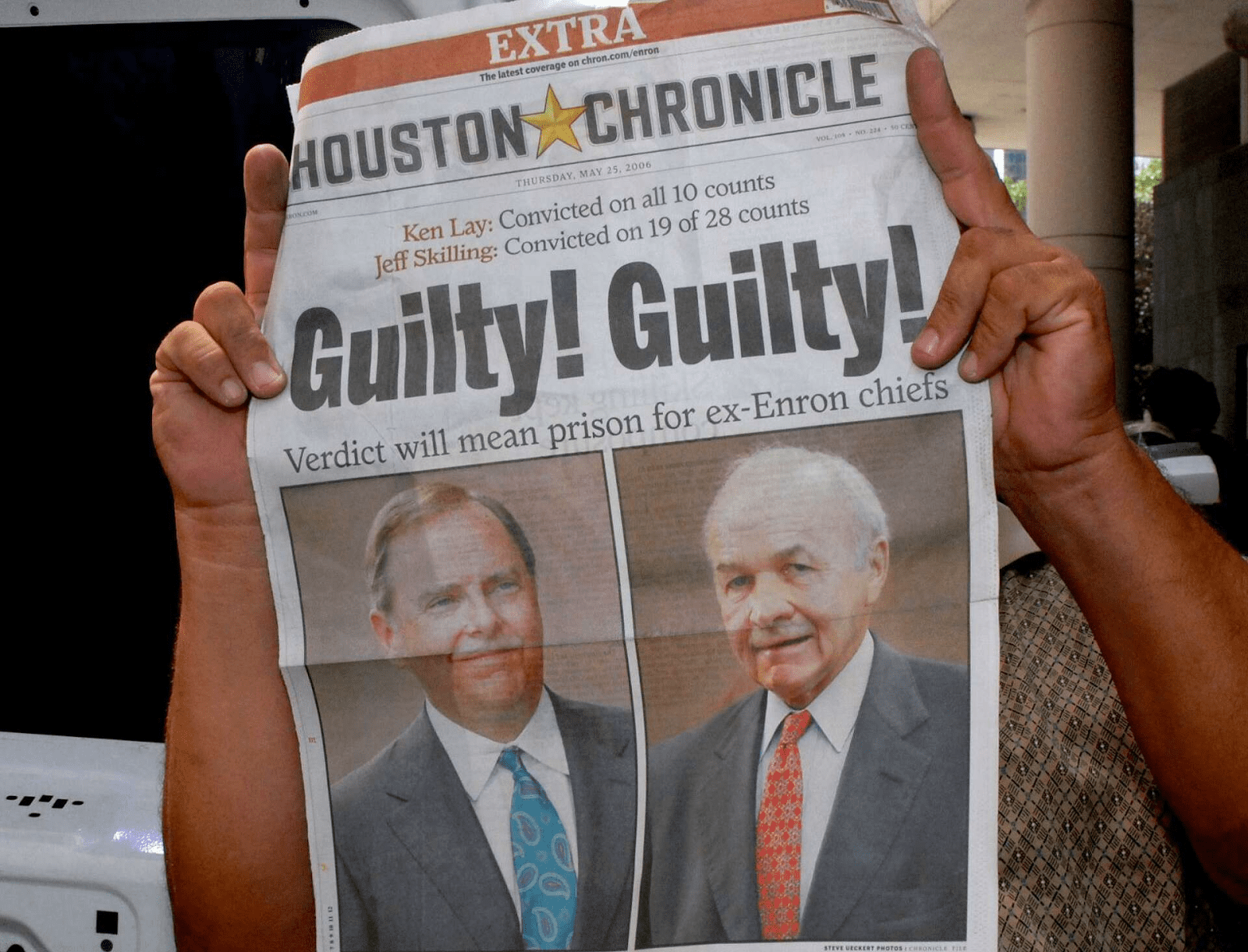

This event shook up not only Houston but also gained nationwide publicity. The top management was charged with economic crimes, fraud and abuse and sentenced to various terms. Enron vice-chairman J. Clifford Baxter was found dead as a result of suicide. CEO Skilling was sentenced to 11 years in prison. His deputy and predecessor Lay died of a heart attack while awaiting sentencing. CFO Fastow was sentenced to 6 years.

A. Andersen was placed under supervision and lost his clients. Thus, the audit firm he worked for also went bankrupt, as clients refused to continue working with them. Along with Andersen’s audit firm, several dozen Enron subsidiaries were declared bankrupt.

But ordinary people suffered the most. Thousands of employees suddenly lost their jobs. Tens of thousands of ordinary shareholders who had invested in the company with the hope of securing their retirement lost their investments. Although the lawsuits resulted in $85 million in damages, this did not cover all of the shareholders’ losses.

The precedent of Enron led to the creation of new amendments to the legislation to improve the accuracy of financial reports and prevent fraud in this area.

Enron fraud at the heart of books and movies

Such a huge scandal did not escape the attention of the media. The entire trial was actively covered in the press and on television. Fortune Magazine’s Bethany McLean and Peter Elkind conducted a detailed series of investigations into the fraud. They conducted their own investigations and truthfully described the essence of the scam of the century. Their work became a bestseller. In addition to the fourth estate, filmmakers became interested in the Enron fraud. First, one of the corporation’s former employees, Brian Cruver, wrote the book, Enron: The Anatomy of Greed The Unshredded Truth from an Enron Insider. It was published in 2002. The book was later adapted into a television movie, The Crooked E: The Unshredded Truth About Enron.

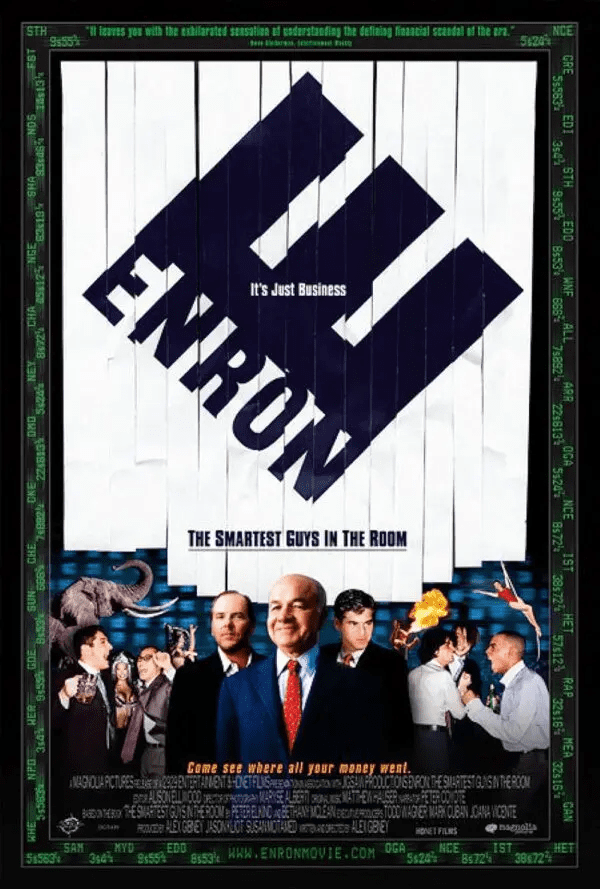

Based on these events, director Alex Gibney made a feature-length documentary about unrelenting greed, volatile stock manipulation, energy futures speculation and tens of thousands of defrauded shareholders, titled Enron: The Smartest Guys in the Room. The nearly 2-hour-long film was presented to the public in 2005 and received a 4.5 out of 5 rating.

This story makes us realize once again that greed and big money, as well as the desire to cheat, do not lead to anything good.